I am writing this because my liberal instincts appear to be in conflict. But probably not. Let me explain.

First, I am a fan of running the economy hot, and think this can be good for productivity and helping the less well-off. Second, I am pro-economics, and happen to think that means being in favour of actions that increase the supply capacity of the economy. Third, I am pro-immigration, and see it as a subset of being pro-economics. Immigration broadens the market, increases effective labour supply, and provides opportunities to all sides of the bargain.

The problem is that these can appear in conflict with each other. “Running the economy hot” is (in some eyes) synonymous with “operating above your short-term labour supply”. For some commentators, it follows that it is good to do this by interfering in the labour market to cut supply, such as putting limits on immigration. (It does not have to be immigration – rules that insist on absurd qualifications to operate in a particular profession, or social rules banning certain types from working, or default retirement rules – all would achieve the same hit to the supply side.)

I don’t think my fundamental views are in conflict, but first I thought it worth just expanding on them a little.

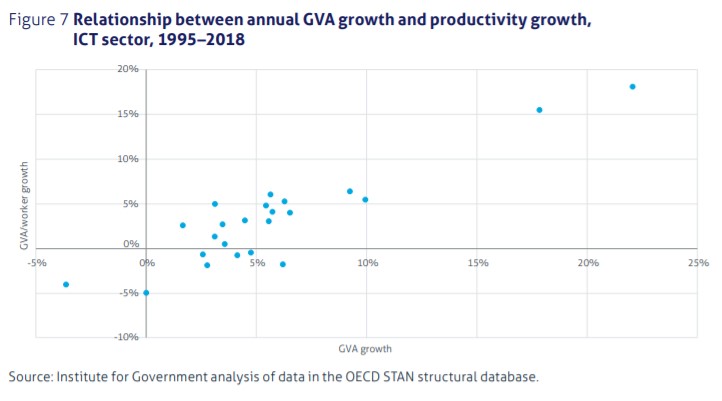

- I like the idea that running the economy hot might lead to improvements in productivity. I pushed this somewhat coyly in my piece about sectors and productivity, published a month back. It was hard not to see a suggestive link between higher levels of activity and productivity. On a year-by-year basis, the pattern is clear. See the IT sector in the chart below. Big up-years like 1999 saw massive increases in productivity. The top-line is clearly in the driving seat:

The pattern can also be seen sector-by-sector. Higher GVA growth sectors are higher productivity growth sectors (see figure 13 in the report).

That hot demand growth might drive productivity is also a half-spoken premise of Biden’s economic programme. Read this by Claudia Sahm, an outspoken critic of the “but we’re overheating” school. Her side would argue that the big mistake after the Great Recession was to run the economy too cold – “a timid policy response in the face of the Great Recession led to immense damage in our productive capacity”. Lowball your guess of the economy’s true potential and, tragically, your weak response may make your under-estimate come true. Janet Yellen in a 2016 speech laid out some of the mechanisms by which a high-pressure economy can unlock productivity-growing behaviour: “additional capital spending … a tight labor market might draw in potential workers who would otherwise sit on the sidelines … higher levels of research and development spending and increasing the incentives to start new, innovative businesses”. In short: necessity is the mother of invention, and demand that runs far ahead of supply forces provides that necessity, so companies raise supply by investing, training and so on.

2. Economists should be wary of ideas that cut supply. If your policy goal is higher output, it is almost axiomatic that should be very wary with ideas that restrict supply. Sometimes, sectional interests blind us to this rather fundamental point. A society with more corn is better off than one with less, even if a few domestic corn-producers would rather the supply coming from everyone else were restricted. I have always struggled to applaud Roosevelt’s decision to slaughter animals and plough up the cotton crop. Surely there are other ways of supporting prices in a hungry society? The whole story of economic growth, told over the long term, is of increased supply. More capital, more labour entering the workforce, better technology enabling it to combine for more output – that is what we are aiming for.

3. But I have been sympathetic to the idea that over-supplied/over-loose labour markets can bias us to low-productivity outcomes. A good statement of this case can be found in Martin Sandbu’s Free Lunch blog, and his book The Economics of Belonging. Low-wage, high-employment economies generate less incentive to enhance the value of each worker. Martin uses the example of car washes, which in the US involve a few people on the minimum wage crawling over your motor, and in Norway just one worker and a very fancy machine. I found good suggestive evidence in international comparisons of how different countries (with different labour rules) recovered from the Great Recession. The lightly-regulated, such as the UK, went the high-employment, low-output-per-head route, when compared to France, say. In this line, I have been very influenced by Ryan Avent’s The Wealth of Humans, which (inter alia) documents the multiple effects of the explosion in aggregate labour supply seen in the 20 years up to writing. Here is my review of it.

A glib way of expressing points 1 and 3 is on a simple supply-demand curve. If your object is higher wages, then generate higher demand for and lower supply or labour. This is the basic model underlying the argument made by Larry Elliott here – that Brexit is great for the low-paid in the casual labour economy: vote leave, tighten the labour market, get wage rises.

So does the “supply is good” rule break down when what is being supplied is labour? Avent and Sandbu are not simplistic one-period supply and demand curve people. Their arguments are more dynamic, looking more at the incentives provided by tighter labour markets, and also the special role played by labour in the economy; as well as being a factor of production, labour is the means by which people lay claim to a portion of the value produced. There are, after all, a huge number of factors of production. Buildings, land, energy, semi-conductor chips, spectrum, lorry driver capacity, cobalt – depending on what you are producing, any of these might be scarce and therefore a matter of concern for a production manager*. But labour is the one that is most directly, most intimately connected to pay, to welfare outcomes.

I see the case. Flood the market with too much labour, and you end up with over-staffed, low-paid car washes, and a society biased towards lower productivity industries. I have read accounts of how Britain enjoyed an Industrial Revolution, and not China, because Britain suffered labour-scarcity, and China’s problem was land. When it comes to immigration, I have even heard the argument raised around the Cabinet table (in committee): a Secretary of State cheerfully reported how the Arts sector was being forced to look domestically for its labour force in the wake of Brexit. The PM applauded.

But if memory serves, neither Avent nor Sandbu are immigration hawks, and nor are economists such as Jonathan Portes who have produced brilliant work looking closely at its effect on native labour. Read Jonathan’s co-authored piece (page 2) for an object lesson in how this is about so much more than pure supply and demand. Immigrants affect labour market outcomes in multi-faceted ways. Don’t fall for batting-average fallacies**, for starters. Look at how new workers change the possibilities for the existing ones. Look at spillovers, geographical effects, incentives, the knock-on effects of economic demand, and more. The net result? Immigration does very little to lower native wage outcomes (see BOE report).

I also think one should distinguish different means by which labour supply might be curtailed. A decent minimum wage is fine – there is monopsony power in the labour market, and it is quite acceptable for society to decree that employers should strive to create jobs that have a floor to their productivity. If some economists see this as an artificial curtailment of the supply of labour willing to work at <£5/hour rates, then that is a curtailment I am fine with. Against this, rules telling people they are not allowed to work in different geographical locations, beyond a certain age, or an unduly limited number of hours are not. The medieval guild system, which prevented out-of-towners from practicing their trade and presumably putting downward pressure on pay, was not altogether a good thing, even if it helped maintain some local wages.

This leads to another point. One-eyed analyses that seek to maximize outcomes for just one group – the incumbent worker, say – can come down in favour of damaging supply limits because they fail to include other relevant groups. My musings on this subject were triggered by the lorry driver shortages. A very narrow analysis might look at the upward pressure on HGV driver wages and, like Larry Elliott appears to, stop there. Higher wages good! Hooray for Brexit! But the shortage of HGV drivers is clearly not a good thing, and any actions that are preventing new drivers entering this hot market are damaging. Consumers are suffering from higher prices and empty shelves. More broadly, to the degree that the economy is suffering from shortages because of artificial restrictions on the movement of labour, post Brexit, that is also damaging to the workers that might have come here, earned money and helped the economy. Without them, the whole economy is less efficient. The pie is being shrunk.

So, cutting to the chase in an already overlong post, I am comfortable with all my views, still. Run the economy hot but only by raising demand. Higher demand that raises the value of labour, and induces employers to find ways of getting more from each hour worked, is a good thing. Restrictions on labour supply that cut the potential of the economy and damage people’s opportunities are not. Self-induced privations are not a good policy tool, even if they give you some incentive to innovate. After all, perhaps the best known example of lower labour supply raising wages was meant to be the Black Death (1346-8?), which I was taught was great news for the peasants that survived, as it boosted their bargaining power (although this work suggests wages didn’t start rising for 30 years.) But, seriously – can anyone really sit back and say the Black Death was a Good Thing?

*this is one reason I find the sole interest in productivity as measured by “value produced per unit of labour” as a little maddening – there are many cases where it is some other factor that is the limiting one. Semi-conductors for the car industry, say? Energy, for the world as a whole? Carbon

**This is what I would snappily call the All the Averages are Lower and Yet People are Better Off Paradox (that spoilsport Chris Dillow reminded me it is actually Simpson’s Paradox). When a talented immigrant who at home earns a higher-than-average income travels to a richer country, where his pay rises to a level below the prevailing richer-country-average, the average per-head incomes in each country falls, yet world income/capita rises. Averages mislead: this is another lesson I learned writing about UK productivity and sectors

One thought on “Shortages are really not such a good thing”